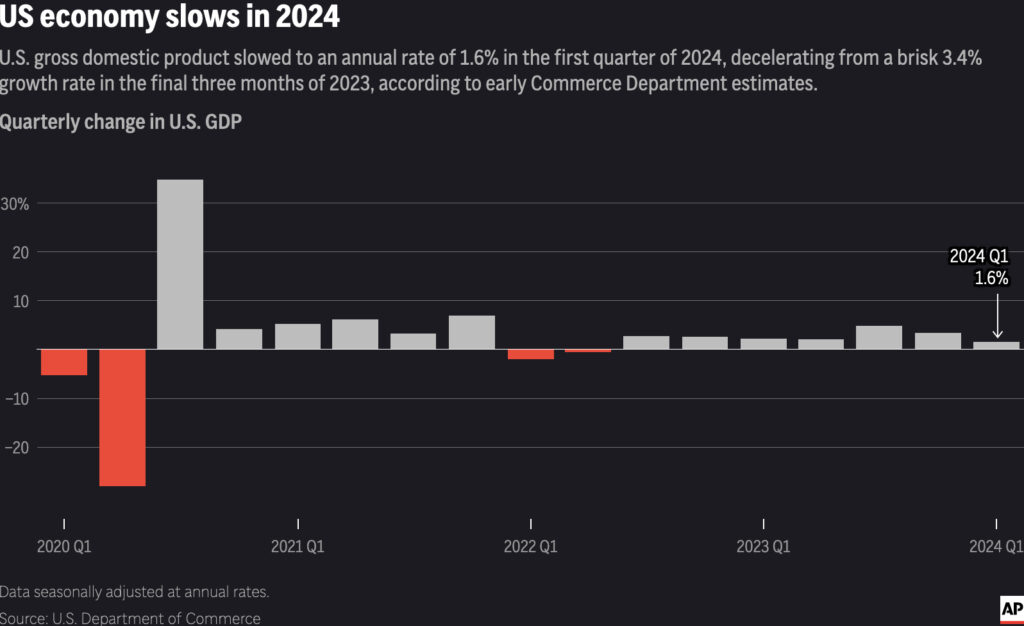

AP: US Growth Slowed Sharply Last Quarter

The nation’s economy slowed sharply last quarter to a 1.6% annual pace in the face of high interest rates, but consumers — the main driver of economic growth — kept spending at a solid pace.

Thursday’s report from the Commerce Department said the gross domestic product — the economy’s total output of goods and services — decelerated in the January-March quarter from its brisk 3.4% growth rate in the final three months of 2023.

A surge in imports, which are subtracted from GDP, reduced first-quarter growth by nearly 1 percentage point. Growth was also held back by businesses reducing their inventories. Both those categories tend to fluctuate sharply from quarter to quarter.

By contrast, the core components of the economy still appear sturdy. Along with households, businesses helped drive the economy last quarter with a strong pace of investment.

The import and inventory numbers can be volatile, so “there is still a lot of positive underlying momentum,’’ said Paul Ashworth, chief North America economist at Capital Economics.

The economy, though, is still creating price pressures, a continuing source of concern for the Federal Reserve. A measure of inflation in Friday’s report accelerated to a 3.4% annual rate from January through March, up from 1.8% in the last three months of 2023 and the biggest increase in a year. Excluding volatile food and energy prices, so-called core inflation rose at a 3.7% rate, up from 2% in fourth-quarter 2023.

From January through March, consumer spending rose at a 2.5% annual rate, a solid pace though down from a rate of more than 3% in each of the previous two quarters. Americans’ spending on services — everything from movie tickets and restaurant meals to airline fares and doctors’ visits — rose 4%, the fastest such pace since mid-2021.

But they cut back spending on goods such as appliances and furniture. Spending on that category fell 0.1%, the first such drop since the summer of 2022.

Gregory Daco, chief economist at the tax and consulting firm EY, noted that the underlying economy looks solid, though it’s slowing from last year’s unexpectedly fast pace. The rise in imports that accounted for much of the drop in first-quarter growth, he noted, is “a sign of solid demand” by American consumers for foreign goods.

Still, Daco said that the economy’s “momentum is cooling.”

“It’s unlikely to be a major retrenchment,” he said, “but we are likely to see cooler economic momentum as a result of consumers exercising more scrutiny with their outlays.”

Read the full report from the Associated Press here.