Costs of Doing Business in 2025

How changes to tariffs may affect your parts and accessories operation, and a possible solution.

The state of the industry is the primary theme of this month’s issue of RV PRO. Like most other industries, our industry is impacted by decisions made at a higher pay grade. One of these decisions is predicted to focus on tariffs placed on goods and materials imported from other countries.

Though most, if not all, of the RVs sold in the United States are produced in the U.S., some of the parts, accessories and materials used in manufacturing and servicing those RVs are produced in other countries.

Perhaps you are wondering how that is related to your parts and accessories operation or to the state of the RV industry. If tariffs are imposed on goods from other countries, then the cost of those goods purchased by your suppliers will increase. This increase in cost will be transferred to you and eventually to your customers.

Some examples of these cost increases are provided so that you can gauge the possible impact of increased tariffs on your operations.

Example 1: Suppose your average gross profit percentage of your parts and accessories department operations is 33%. This requires an average markup of 50% over cost. Assume you have a high-volume maintenance item that has a current cost of $5 and a high-volume accessory item that has a current cost of $400. For the maintenance item, assuming you desire a 33% gross profit, you would sell that item for $7.50, which yields a gross profit of $2.50 and a gross profit percentage of 33%. For the accessory, you would sell it for $600, which yields a gross profit of $200 and a gross profit percentage of 33%.

Some financial pundits are suggesting that tariffs on some countries’ goods could be 60%. If we apply that additional 60% to the costs of the two items from our examples, the selling price of each item increases substantially relative to the current cost.

The maintenance item now has a cost to you of $8 ($5 x 1.6 = $8). Your selling price, assuming you still require a 33% operating gross profit percentage to cover your operating costs and still make a net profit, is now $12. This is a $4.50 increase to your customers.

Doing the arithmetic on the accessory, the new cost to you will be $640, which generates a selling price of $960 — an increase of $360.

You might now be asking: So, what can I do about it since I don’t have any control over decisions made at upper levels of government?

A possible solution, which is a contradiction of some of my inventory management suggestions, is to bulk up on those high-sales volume items before the tariffs are implemented.

But how many of each qualifying item should you purchase without taking the chance of being stuck with them? Perhaps some additional examples could assist you in making those decisions.

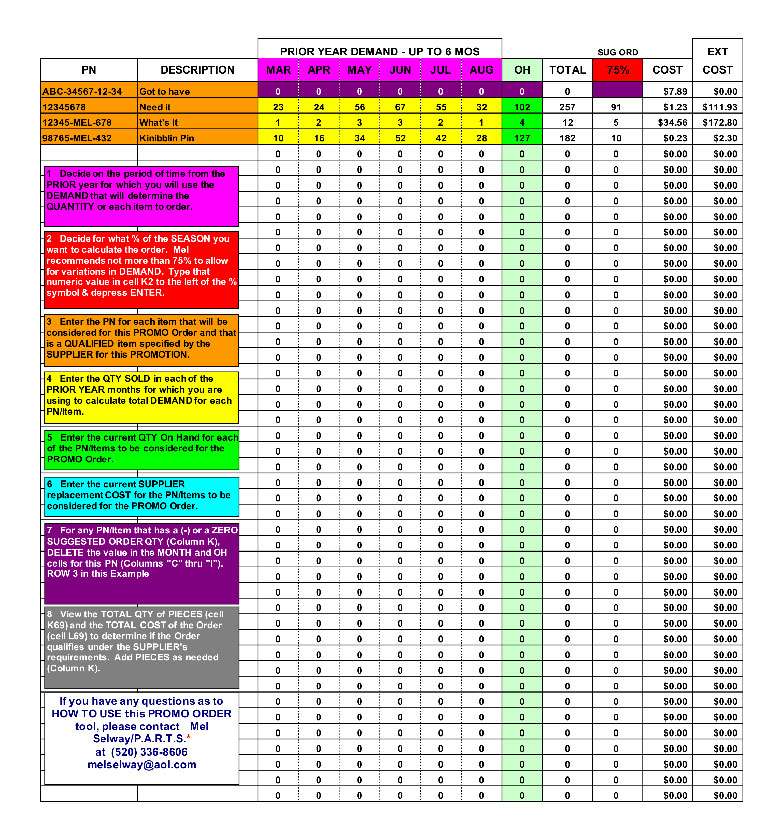

Note: I have an Excel tool that could be used to assist in some of these calculations if you feel it would assist you. The file is named Promo Order Tool 021915 if you decide to email a request for the tool.

Example 2: Assume that you will be ordering for a six-month period that reflects your high-selling season. We will use the two items from our previous example in this example because one is a low-cost maintenance item and the other is a higher-cost accessory.

In our example, the period of prior year demand covers the six months March through August; however, you should select the season for which you will be ordering. You have decided you can afford to order 80% of the quantity sold for each item.

The maintenance item generated 257 sales during the subject period, and there are 28 on hand. Calculating an 80% order based on the 257 sales = 206 less the 28 on hand = 178 to order.

For the accessory, 42 sales were reported for the six-month window. Calculating an 80% order based on those 42 sales = 34 less the 4 on hand = 30 to order.

Note: When reviewing each of the qualifying items, also determine if any are on order or backorder and also reduce your suggested order quantity by that amount — assuming the data is accurate!

Referring to my December RV PRO column wherein we discussed those items in your inventory that incurred more than 40 demands per year, if you calculated the 80% order quantity for each of those items, you should have a reasonable suggested order to review.

As part of your order review process, I suggest that you decide if the qualifying items based on last year’s sales could possibly experience a similar demand for the 2025 season. For any items that you can’t justify at least a similar demand, perhaps calculate a supply less than 80% minus the on-hand and on-order/backorder quantity for each.

After processing your suggested order calculations and review, you might contact suppliers and request a discount for the volume of goods that you are ordering. If the supplier representatives ask why you are placing these bulk-up orders, explain that you are ordering frequently requested goods for the season to minimize stock-out conditions and to reduce the order processing time for these high sales volume items.

Concerned with possibly getting stuck with these excess items? Since you purchased them at the current cost (and possibly got a discount, which should have been applied as earned income), then you could always offer them to other dealerships at a lower price than they would be paying due to the tariff increases. Your cost could easily be less than the tariff-inflated costs from the suppliers.

Whew! That seems like a lot of work. Perhaps it is. However, if you want to control your costs of doing business in 2025, within an environment over which you have no control, then I suggest that it is worth the investment of your time and money. And, by controlling your costs, you offer a lower price for some of your most popular goods, which could generate more business as customers realize that you are offering the same items at lower prices than other RV dealerships.