Dealers Favor Used Inventories in Baird Survey

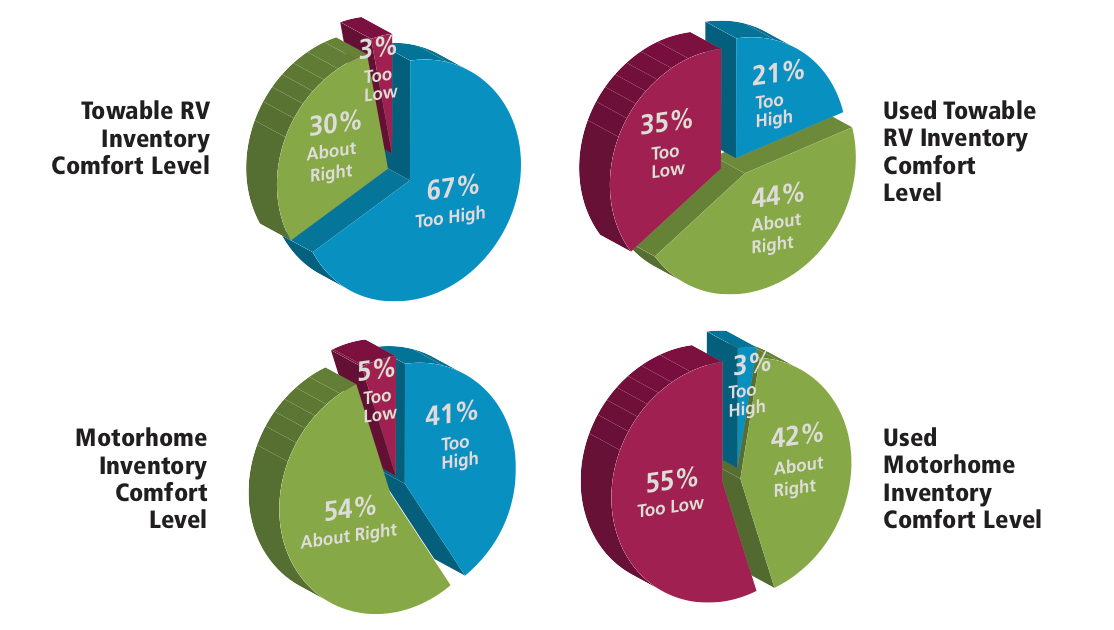

Dealers surveyed late in October said their new towable RV inventories were too high, while their used towable inventories were balanced, according to Robert W. Baird & Co., the Milwaukee-based investment firm that surveys dealers quarterly in partnership with RVDA.

This story by Jeff Kurowski originally appeared in RV Executive Today.

The Baird firm feels dealers’ belief that their towable inventories were too large was fueled by the desire they have each year to reduce inventories during the fourth quarter. Higher interest rates also were a factor. As one dealer wrote, “There is too much inventory on dealers’ lots. We have to get better inventory turns to make money, as our profits have been squeezed the past two years. With rising interest rates, we can’t afford to stock what we once did.”

Dealers surveyed in late October said they had a 120-day supply of towables, compared with 114 days in late July and 114 days in October 2017.

Another dealer said, “We continue to see weakness in stick and tin. Margins are stressed. The selling point that works is under $20,000, but the unit needs to be 28 to 30 feet. We are dumping at any cost; the gap between fiberglass walls and stick and tin is closer than in the past. Customers are comparing floor plans more than exteriors or unit class.”

In the motorized sector, dealers estimated their days supply was 119 days as of late October, which was lower than 127 days in late July and 129 days as of October 2017. But one motorhome dealer reported that “higher interest rates are negatively effecting overall business and are the reason for flat sales for new units and a big increase in sales of used.”

Another dealer said that Class A’s are “questionable in our market today, but Class C’s are still doing well.” Yet another reported, “The price point is changing – we’re selling more gas to diesel and seeing a good turn on diesel Class B’s when we can get them.”