Leading Economic Index for the US Declined in June

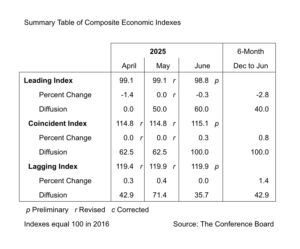

The Conference Board Leading Economic Index (LEI) for the US declined by 0.3% in June 2025 to 98.8 (2016=100), after no change in May (revised upward from –0.1% originally reported). As a result, the LEI fell by 2.8% over the first half of 2025, a substantially faster rate of decline than the –1.3% contraction over the second half of 2024.

“The US LEI fell further in June,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at The Conference Board. “For a second month in a row, the stock price rally was the main support of the LEI. But this was not enough to offset still very low consumer expectations, weak new orders in manufacturing, and a third consecutive month of rising initial claims for unemployment insurance. In addition, the LEI’s six-month growth rate weakened, while the diffusion index over the past six months remained below 50, triggering the recession signal for a third consecutive month. At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow substantially in 2025 compared to 2024. Real GDP is projected to grow by 1.6% this year, with the impact of tariffs becoming more apparent in H2 as consumer spending slows due to higher prices.”

“The US LEI fell further in June,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at The Conference Board. “For a second month in a row, the stock price rally was the main support of the LEI. But this was not enough to offset still very low consumer expectations, weak new orders in manufacturing, and a third consecutive month of rising initial claims for unemployment insurance. In addition, the LEI’s six-month growth rate weakened, while the diffusion index over the past six months remained below 50, triggering the recession signal for a third consecutive month. At this point, The Conference Board does not forecast a recession, although economic growth is expected to slow substantially in 2025 compared to 2024. Real GDP is projected to grow by 1.6% this year, with the impact of tariffs becoming more apparent in H2 as consumer spending slows due to higher prices.”

The Conference Board Coincident Economic Index (CEI) for the US rose by 0.3% in June 2025 to 115.1 (2016=100), after being unchanged in both May and April. The CEI rose by 0.8% over the first half of this year, down from 1.0% growth over the previous six months. The CEI’s four component indicators — payroll employment, personal income less transfer payments, manufacturing and trade sales, and industrial production — are included among the data used to determine recessions in the US. All components of the coincident index improved in June.

The Conference Board Lagging Economic Index (LAG) for the US was unchanged at 119.9 (2016=100) in June 2025, after increasing by 0.4% in May. The LAG’s six-month growth rate was also positive at 1.4% between December 2024 and June 2025 — reversing a –0.8% decline over the previous six months (June–December 2024).

The next release is scheduled for Thursday, Aug. 21 at 10 a.m. ET.