Model Year 2026 Preview: Grand Design

Grand Design

Foundation

Grand Design RV will officially enter the destination trailer market with the launch of its new brand, Foundation. The rising popularity of destination trailers among consumers makes this a strategically opportune time for Grand Design to enter the market, continuing to meet evolving lifestyle demands through full-time living solutions.

Dual exterior decks, most notably the elevated rear observation deck, serve as a centerpiece of the 42GD, which is a “first-of-its-kind floorplan” with a strong emphasis on residential-grade construction.

“It sets a new benchmark in the destination trailer segment,” Foundation Product Manager Matt Eppers says. “It delivers the comfort and convenience of home in a truly innovative RV design that’s highlighted by the distinctive rear observation deck. This innovative feature is entirely unique within the industry, offering dealers a powerful visual tool to showcase the model’s standout appeal — the 42GD has a striking and memorable first impression.”

The 42GD floorplan blends Grand Design’s craftsmanship with spacious, premium residential features, including a three-stage water filtration system, brass plumbing fittings, 12-volt tank heating pads, full GE kitchen suite, dishwasher prep, and an optional washer and dryer, interior and exterior accent lighting and Starlink prep, as well as slideout toppers.

“This model offers campers an elevated and exclusive outdoor experience,” Eppers tells RV PRO. “And when paired with the 42GD’s uncompromising residential standards, this model transcends the traditional RV experience, offering a premium, living experience that sets a new standard.”

The Foundation will be featured at Open House in Grand Design’s same location as 2024, along Executive Parkway.

Serenova

Grand Design’s Serenova made a splash when it entered the market in 2025 as a compact, feature-packed, lightweight travel trailer with unrivaled comfort in its 160LG floorplan. Building on that success, the unit will continue to make waves in 2026 with its new 150HL floorplan that brings contemporary design elements that maximize functionality.

“With the 2026 Serenova line, we’re redefining what lightweight luxury looks and feels like,” Serenova Product Manager Matt Eppers says. “From sleek Italian-inspired interiors to advanced towing technology and off-grid capability, Serenova delivers a premium travel experience without compromise. It’s where modern design meets real-world functionality.”

Inside, standard features include lightweight acrylic windows with integrated shades for a streamlined look, an 8-cubic-foot flush French door refrigerator and Italian-styled cabinetry with soft-close hinges and doors for a high-end residential feel. A removable induction cooktop offers flexible cooking options both indoors and out, while a spacious dry bath with oversize tank capacities ensures extended comfort on the road. New options for 2026 include a 24-inch TV and a 3000-watt inverter prep.

“This unit features an industry-first dual position bed/lounger system with an integrated headboard design that transforms between a generous 60-by-77-inch bed and a luxurious lounger,” Eppers notes. “The 150HL also offers a large storage full pantry system with integrated spice rack, and an impressive amount of counter space.”

Externally, Serenova is built for performance and durability, featuring a molded fiberglass front cap with an automotive windshield, MORryde independent suspension, Dexter Tow Assist with anti-lock braking and sway control, and a heated, enclosed underbelly. A standard solar package, complete with a 200-watt panel and 30-amp charge controller, supports off-grid capability, making Serenova as functional as it is stylish, he says. “Grand Design is proving that exceptional living shouldn’t require exceptional space.”

Transcend

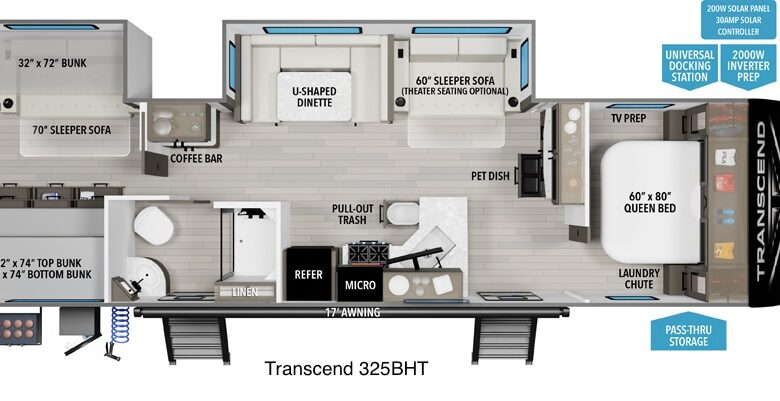

New floorplans abound for Grand Design’s Transcend, which will introduce the 131DL in the Transcend One line, the 21RLX and the 23BHX floorplans in the Transcend Xplor line, and the 325BHT floorplan in the Transcend line.

In 2025, the Transcend One segment secured the No. 3 position among the bestselling single-axle travel trailers in the industry during its inaugural year, according to Grand Design. Its emphasis on kitchen functionality — including dedicated storage for trash cans and pots and pans, as well as an integrated paper towel holder — has resonated strongly with customers, reinforcing the company’s commitment to practical, user-focused innovation. Expect more to be on track for the new model year.

“For 2026, we’re introducing a range of new standard features that elevate both style and functionality across our lineup,” Transcend Product Manager Matt Eppers tells RV PRO. “What stands out most is the completely refreshed look of the Transcend line, paired with an intensified focus on livability and functional design. The latest features are thoughtfully crafted to provide a seamless transition from home to campsite, delivering a more intuitive and comfortable experience for today’s modern RV lifestyle.”

The new interior and exterior decor packages introduce a refined, luxurious aesthetic designed to captivate both dealers and consumers, he adds. Drawing inspiration from the latest trends in residential design and automotive styling, these updates deliver a contemporary look.

Highlights include updated flooring, countertops, furniture and cabinetry, complemented by refreshed exterior graphics. Kitchen enhancements such as integrated spice racks and built-in soap dispensers add everyday convenience, while the transition to tankless water heaters across all models ensures continuous hot water on demand.

Lighting upgrades include flush-mount fixtures throughout and accent lighting on the Xplor line and Transcend models. Additionally, Transcend will now feature an exterior laundry rack, and all units will come standard with Starlink prep.

“The 2026 Transcend lineup is all about thoughtful upgrades,” Eppers says. “We’re delivering more comfort, convenience and connectivity than ever before. With new floorplans across the lineup, there’s a Transcend for every kind of traveler.”

Imagine

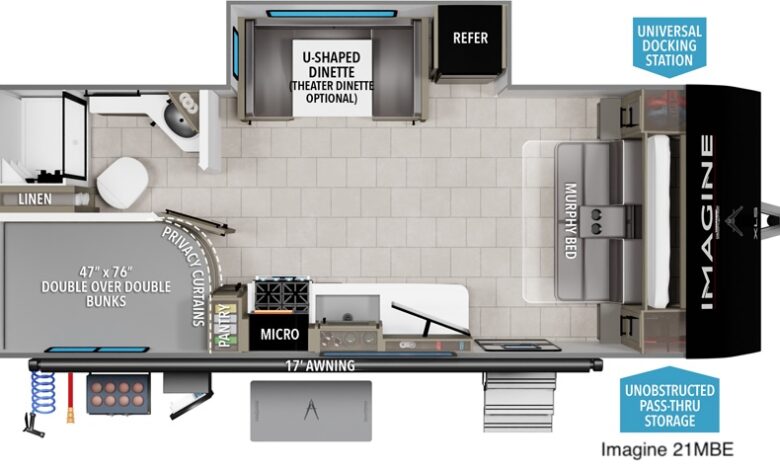

Grand Design promises that both dealers and customers will be thrilled with the 2026 Imagine line, which delivers a comprehensive interior refresh. New floorplans include the 21MBE in the XLS line, the 15RBA and 16MLA in the AIM line, and the 2970RL and 2700BS in the Imagine line.

“The 2026 Imagine lineup is all about elevating everyday comfort with smart, stylish upgrades. From refreshed interiors and expanded storage to thoughtful touches like integrated cutting boards and soft-close features, we’ve focused on the details that make travel feel more like home,” Imagine Product Manager Eric Landis says. “With new floorplans across the AIM, XLS and Imagine lines, there’s something for every kind of adventurer.”

The introduction of GE appliances for 2026 brings a new level of reliability and performance to the kitchen, while upgrades such as built-in paper towel holders, dedicated trash-can storage and dinette pullout drawers enhance day-to-day convenience. Interior updates include new linoleum flooring, contemporary cabinet door styles, black stainless sinks and upgraded furniture.

Practical enhancements include plumbing shut-off valves for easier maintenance, soft-close toilet lids and a redesigned shower with an integrated footrest for added comfort. Select models now also feature a 40-inch TV. A new shade system and larger windows enhance natural light and privacy, and updated mattresses extend to bunk areas. There’s also a versatile two-burner griddle for outdoor cooking and entertaining.

Additional key upgrades include solid-surface countertops in both the kitchen and bathroom, and the MORryde CRE 3000 suspension system that significantly improves ride quality. Safety and towing confidence were also enhanced with the inclusion of ABS and anti-sway technology, addressing common concerns for today’s RVers, Landis says.

“These compact, yet feature-rich layouts resonate with customers seeking maneuverability without sacrificing comfort. Altogether, these enhancements create a more refined, comfortable and user-friendly RV experience that’s sure to impress on the lot and at the campsite.”

Reflection

Form and function are the drivers for the 2026 Grand Design Reflection lineup. What stands out most is its bold new look and upgraded comfort features. The redesigned front cap gives the RV a more modern and aerodynamic profile, while the new exterior graphics package adds a sleek, refreshed visual appeal. Inside, the interior now features all-black appliances for a contemporary look, showcased by Reflection’s introduction of its 32BH, 250ML and 317RSTS floorplans for 2026.

“Reflection has been a standout success this year, with each series strategically positioned to meet distinct market demands,” Reflection Product Manager Ken Conlee says. “The 100 Series has made a strong presence by offering space-smart sanctuaries that are ideal for modern travelers, while the 150 Series has emerged as the perfect mid-range solution for families seeking comfort and versatility. … Our focus on delivering towing confidence and flexible, configurable living spaces has been key to resonating with a wide range of customers.”

Practical enhancements include dedicated waste tank storage, washer/dryer prep for extended stays and the Furrion Chill Cube 18K AC equipped with a heat pump to enhance climate control and deliver efficient, quiet cooling. The addition of Starlink/Gateway prep helps travelers stay connected with upgraded internet connectivity featuring integrated cellular and satellite capabilities.

“The 2026 Reflection lineup is redefining innovation, bringing together bold new styling, an upgraded towing experience and enhanced connectivity to meet the evolving needs of today’s RVers,” Conlee says. “Reflection continues to set the standard for comfort and capability on the road.”

Momentum

For 2026, Momentum will launch continuous residential flooring that extends from front to rear, enhancing durability and transforming the garage into a truly multifunctional space for toys, hobbies, remote work or additional sleeping quarters, Product Manager Chase Booth says.

“The Momentum lineup has a bold integration of features that redefine versatility and comfort that will immediately capture the attention of both dealers and customers in the 2026,” Booth notes.

New floorplans, which include the Momentum M-Class 399M and the Momentum G-class 394G, offer the versatility of a garage space without sacrificing on a residential interior, he says, whether it’s the front-to-rear residential flooring or the drop-down LiftSuite converting the garage into a bedroom that features a full queen bed. A zero gravity, weatherproof ramp door system adds ease and safety to loading and unloading toys.

The L-track tie-down system with rubber inserts offers cargo security and versatility, and its large beavertail storage door offers improved storage and flexibility. The cabinetry features hardwood drawer boxes, soft-close doors and drawers, a power charge drawer and specialized hair accessory drawers.

On the exterior, the new 399M floorplan features its side patio and full outdoor kitchen where Omni Connect functionality brings enhanced connectivity. And the MORryde independent suspension system offers a smoother, more stable ride by allowing each tire to respond independently to road conditions.

“Every detail in the 2026 Momentum line is designed to elevate the way our customers live, work and play on the road,” Booth says. “Momentum isn’t just about hauling toys — it’s about bringing home with you, wherever you go.”

Lineage Class B

The brand-new Lineage Class B Luxury Adventure Vans promise to redefine what’s possible in the world of compact, high-end travel vehicles, Product Manager Stephan Dolzan says. Designed for those who crave both adventure and comfort, the Series VT and Series VP models each bring new innovations to the Class B market.

“This year at Open House, we’re excited to showcase how the Lineage Series is transforming the Class B experience,” he tells RV PRO. “With groundbreaking features like the industry’s most powerful 48-volt AC system, a patent-pending expandable bathroom and panoramic skylights, the VT and VP models blend rugged capability with refined luxury. It’s a bold step forward in redefining what’s possible in compact adventure travel.”

The Series VT 48-volt split AC system is strong for its class, delivering 20,000 Btu of cooling, Dolzan says, and eliminating the need for a roof-mounted unit. This not only enhances cooling performance but also frees up rooftop space for increased solar capacity and storage.

Inside, the VT changes the concept of a van bathroom with a design that minimizes its footprint when not in use and expands into a 6-foot, 3-inch shower when needed.

“For customers, the expandable bathroom and shower in both models is a showstopper, delivering a full-height, spa-like experience in a compact van — something they’ve never seen before,” Dolzan says.

The panoramic front skylight allows natural light into the interior. The VT also boasts the largest countertop in its class, he says, featuring the Invisacook hidden induction cooktop and a drawer-style refrigerator accessible from both inside and outside the van. The VT comes with a factory-installed lift kit, upgraded suspension, rugged wheels and tires, and bold exterior styling, including a Raptor-style grille and custom side pods.

Built on a high-roof ProMaster chassis, the VP offers tall interior height for the Class B segment, Dolzan notes.

“The open-concept floorplan enhances the sense of roominess, while increased storage and seating capacity surpass traditional ProMaster builds,” he says.

A large entry step makes access easier for all ages, while the rear lounge features a functional layout with an overhead lift bed, providing comfortable seating for six and sleeping accommodations for four.

“What will most catch the eye of both dealers and customers about the Lineage Series VT and VP is how these vans completely break the mold of traditional Class B builds,” Dolzan says. “These are not just vans — they’re conversation starters, and they’ll turn heads on the showroom floor and at the campsite alike.”

Lineage Class C

The Lineage Class C line will offer two distinct models — Series M and Series F — each engineered for a premium travel experience. And for 2026, the line will introduce updates that include a new floorplan for the Series M, the 25TK, in addition to the 25FW.

“The Lineage Series M and Series F made a powerful impact on the Class C RV market, as they entered this past year, shaking up the segment,” says Product Manager Michael Hums. “Both models brought fresh energy and innovation, and challenged outdated norms with bold design, cutting-edge technology and true off-grid capability.”

The new 25TK layout features a split twin-to-king convertible bed, offering flexible sleeping arrangements with twins of 36-by-80 inches and 36-by-74 inches, or combined 70-by-80 inches. Both twins featuring dual power incline sleepers.

“It’s a perfect blend of comfort, versatility and luxury for travelers seeking a more personalized experience on the road,” says Hums, adding that the Series M is built on the Mercedes 4500 chassis with a MORryde Halo frame upfit for a smooth, stable ride.

The Series M will also introduce an optional Power Package for 2026. This generator delete option is designed for the off-grid customer, featuring two additional 410Ah Lithionics batteries (to bring total onboard lithium to 1,130 Ah), 3000-watt inverter/charger, secondary alternator with 300 amps with external regulator, 960-watt solar awning (to bring the total onboard solar to 1,500 watts) and C2C technology to tie it

all together.

Climate control is front-to-back AC, powered by COBRA, while the AquaHaven Rainshower System and modern bath essentials elevate the onboard bathroom experience. The Series M 25TK also includes full-width rear cargo storage, a fully walkable (low-maintenance) fiberglass roof, and a smart culinary setup with a 12-volt, 10-cubic-foot refrigerator and smart sink. Premium touches such as SharkBite plumbing, acrylic windows with integrated shades and screens, a built-in headrest safe, and a Rockford Fosgate sound system round out the luxury build.

Meanwhile, the Series F is built on the rugged Ford Super Duty F-600 4×4 chassis and equipped with Fox Factory suspension, making it ideal for true off-grid adventures. A custom Ford Raptor-style grille adds aggressive styling. It features a 320Ah Lithionics battery system and 1,000 watts of solar power, “delivering unmatched energy independence,” Hums says. “With over 110 cubic feet of exterior storage, it’s ready for extended journeys.”

Inside, the Series F offers a 70-inch-by-80-inch Indratech king bed, the COBRA cab-over bunk ram air system and the same premium features found in the Series M, including SharkBite plumbing, acrylic window package and a built-in headrest safe. A stacked washer/dryer cabinet that offers additional inside storage is optional.

“Dealers and customers alike are going to be especially drawn to how the Lineage Series M and Series F combine luxury, innovation, and practicality in ways that truly stand out in the Class C market,” Hums says. “For dealers, these models are easy to showcase thanks to their premium chassis platforms and customers will love the residential-style sleeping options. These are not just RVs — they’re complete lifestyle upgrades that are sure to excite on the showroom floor and on the open road.”

Influence

The 2026 Influence line will introduce a host of new standard features that elevate both performance and livability with two new floorplans, the 3003RL and 3904BH.

“What will immediately catch the eye of both dealers and customers in the 2026 Influence line is its perfect balance of style and smart design,” Product Manager Logan McBride says. “The refreshed exterior graphics give the coach a bold, modern presence on the lot and on the road, while the all-new interiors are bright, timeless and designed to feel like home.”

At the foundation is the MORryde independent suspension system, delivering a smoother, more stable ride by allowing each tire to respond individually to the road, while practical upgrades include deep drawer storage for kitchen utensils, a pass-through hamper and flip-up steps for optimized storage solutions. The Omni Connect system ensures internet access without the hassle of switching providers, and the advanced roof construction offers long-term durability with minimal maintenance.

“The 2026 Influence line is all about delivering a premium experience from the ground up,” McBride says. “The new 3904BH floorplan is a perfect example of how Influence continues to evolve with the needs of today’s travelers.”

Solitude

A major highlight for the Solitude in 2026 is its all-new 414LJMJ floorplan, inspired by the theory of “Less Junk, More Journey” for full-time travelers. The layout includes a full outdoor kitchen with a zero gravity fold-down side patio, a residential 60-by-30-inch bathtub, a bedroom dresser with a 40-inch fireplace and hideaway televator, and a spacious L-shaped sofa with a pullout ottoman.

Among other top highlights are the MORryde independent suspension system for enhanced towing and an advanced roof construction that boosts durability and insulation.

The integration of Omni Connect ensures internet connectivity, while the new interior designs bring a fresh, upscale feel throughout the coach.

“We have a lot to be proud of this year, but one of the biggest successes we saw was our thoughtful storage initiatives,” Product Manager Logan McBride says. “From sliding dressers and end tables and electronics drawers to adjustable pantry shelving with outlets, we ensure that everything you are traveling with has a designated space — and allow you to reduce clutter and keep your unit looking new for years to come.”

Solitude’s all-new interior also features Ultrafabrics furniture, deep drawer storage for kitchen utensils and dishwasher prep for added convenience.

“The new interiors bring a fresh, upscale aesthetic that feels like home,” McBride says. “Together, these features make the 2026 Solitude line the ultimate expression of full-time luxury RV living.”