Report: EVs Represent 15% of 2023 New Light-Duty Vehicle Sales

Alliance for Automotive Innovation released its state-by-state analysis, spotlighting Colorado below, of the U.S. electric vehicle (EV) market for Q4 and full year 2023.

The Get Connected Electric Vehicle Report summarizes EV sales, purchasing trends and charging infrastructure across the country.

For full-year 2023 EV sales: Nationally, EVs represented 9.5% of new light-duty vehicle sales in 2023, up from 7% in 2022 and 4.3% in 2021.

The market share of new EV sales in Colorado was 15.1% — up from 9.7% in 2022 and 6.2% in 2021.

Nationally, EVs represented 10.2% of new light-duty vehicle sales in Q4 2023, up from 10.1% in Q3 2023 and 8.5% in Q4 2022.

The market share of new EV sales in Colorado was 18.2% – up from 17.9% in Q3 2023 and 11.2% in Q4 2022.

Public EV charging:

Nationally, there are 4.3 million EVs on the road and a total of 159,842 publicly available charging outlets – a ratio of 27 EVs for every public port. This includes 37,922 DC Fast chargers which charge battery electric vehicles in 20 minutes to one hour.

There are 111,282 EVs on the road in Colorado and 4,961 publicly available charging outlets — a ratio of 22 EVs for every public port. This includes 944 DC Fast chargers. Colorado ranks 30th in the ratio of EVs to public chargers.

In Colorado, Denver County had the most public charging ports, with 865. Eight counties in Colorado had yet to install a public charging port by the end of 2023.

National public EV charging still lags:

- 1.2 million public chargers (1,067,000 Level 2 and 182,000 DC Fast) are required to meet the National Renewable Energy Laboratory’s necessary infrastructure estimate for 2030 (Level 2 ports can charge battery electric vehicles in 4-10 hours)

- Nearly 1.1 million more public chargers (945,000 Level 2 and 144,000 DC Fast) need to be installed

- Put another way, 437 chargers will need to be installed every day, for the next seven years — or nearly three chargers every 10 minutes — through the end of 2030

Alliance for Automotive Innovation’s Get Connected Electric Vehicle Report is released quarterly and is the most comprehensive state-level analysis of the U.S. EV market, the company said.

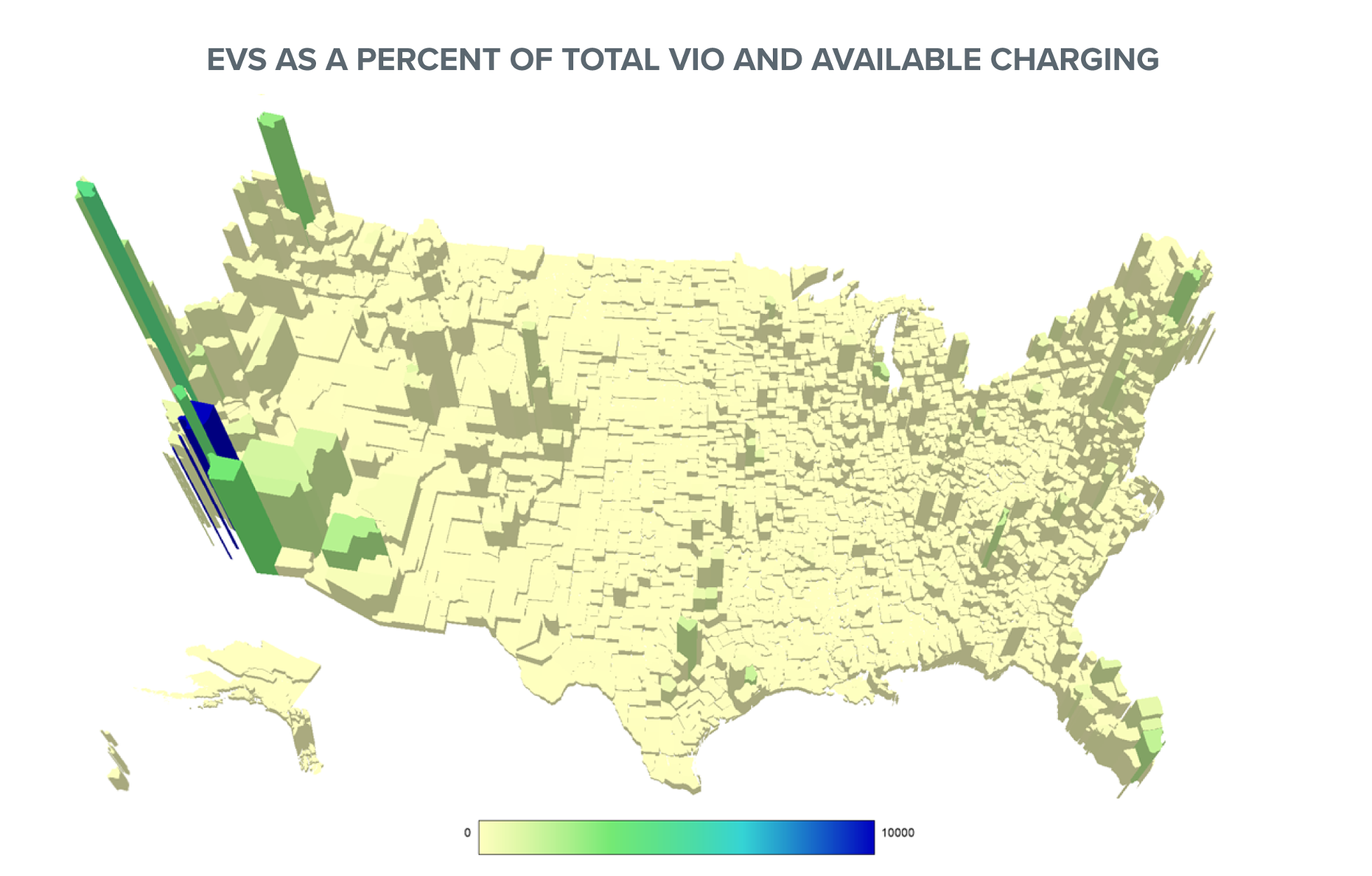

See the graph below, with height representing percent of EVs in operation and color representing public charging: