REV Group Reports Strong Q3, Continued Momentum

REV Group Inc., a leading manufacturer of specialty and recreational vehicles, reported results for the three months ended July 31. Consolidated net sales in the third quarter 2025 were $644.9 million, compared to $579.4 million for the three months ended July 31, 2024. Net sales for the third quarter 2024 included $44.2 million attributable to the bus manufacturing businesses. Excluding the impact of the bus manufacturing businesses, net sales increased $109.7 million, or 20.5% compared to the prior year quarter. The increase, excluding the impact of the bus manufacturing businesses, was due to higher net sales in the specialty vehicles and recreational vehicles segments.

The company’s third quarter 2025 net income was $29.1 million, or $0.59 per diluted share, compared to net income of $18.0 million, or $0.35 per diluted share, in the third quarter 2024. Adjusted Net Income for the third quarter 2025 was $38.6 million, or $0.79 per diluted share, compared to Adjusted Net Income of $24.8 million, or $0.48 per diluted share, in the third quarter 2024. Adjusted EBITDA in the third quarter 2025 was $64.1 million, compared to $45.2 million in the third quarter 2024. Adjusted EBITDA for the third quarter 2024 included $6.6 million attributable to the Bus Manufacturing Businesses. Excluding the impact of the bus manufacturing businesses, Adjusted EBITDA increased $25.5 million, or 66.1% compared to the prior year quarter. The increase, excluding the impact of the bus manufacturing businesses, was primarily due to higher contribution from the specialty vehicles segment.

“We are pleased with our continued momentum this quarter, highlighted by robust growth in shipments and earnings across the specialty vehicles segment. Third quarter performance reflects the continued improvement of our manufacturing capabilities, the strength of our customer relationships, and operational resilience in a dynamic market,” said Mark Skonieczny, REV Group Inc. president and CEO. “We delivered strong cash flow from operations, reinforcing our solid balance sheet and liquidity position. This financial strength gives us the flexibility to continue investing in our business and expanding production capacity while advancing our strategic agenda aimed at creating value for both customers and shareholders. Within the quarter, we also executed on our expanded capital investment plan aimed at increasing production capacity. In August, we broke ground on an expansion of our Spartan Emergency Response facility in Brandon, South Dakota, which will increase our manufacturing footprint and fabrication capabilities of custom and semi-custom vehicles to help us meet demand.”

REV Group Third Quarter Segment Highlights

Recreational Vehicles Segment

Recreational vehicles segment net sales were $161.7 million in the third quarter 2025, an increase of $14.3 million, or 9.7%, from $147.4 million in the third quarter 2024. The increase in net sales compared to the prior year quarter was primarily due to higher shipments of motorized units in certain categories and pricing actions, partially offset by increased dealer assistance on certain models. Recreational vehicles segment backlog at the end of the third quarter 2025 was $224.3 million, a decrease of $16.0 million compared to $240.3 million at the end of the third quarter 2024. The decrease was primarily the result of lower order intake in certain categories.

Recreational vehicles segment Adjusted EBITDA was $8.1 million in the third quarter 2025, a decrease of $1.3 million, or 13.8%, from $9.4 million in the third quarter 2024. The decrease was primarily due to the impact of tariffs related to the import of luxury vans and increased dealer assistance on certain models, partially offset by higher shipments of motorized units, pricing actions and cost reduction initiatives.

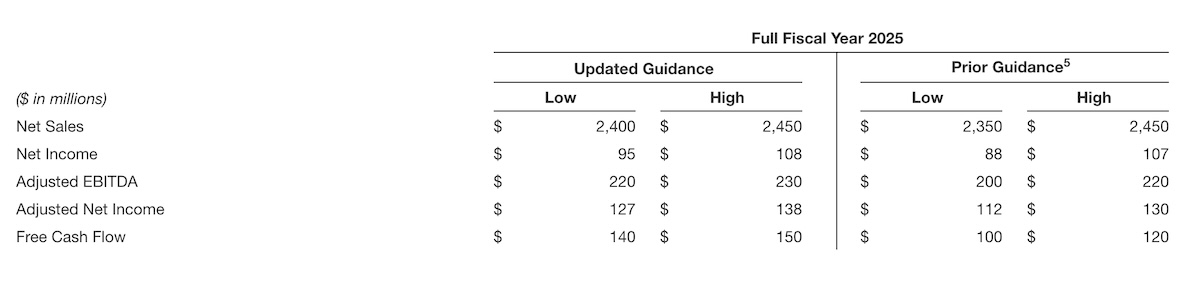

Updated Fiscal Year 2025 Outlook

Click here to view the full release and reconciliation tables.