Surge in RV Shipments Projected Through 2021

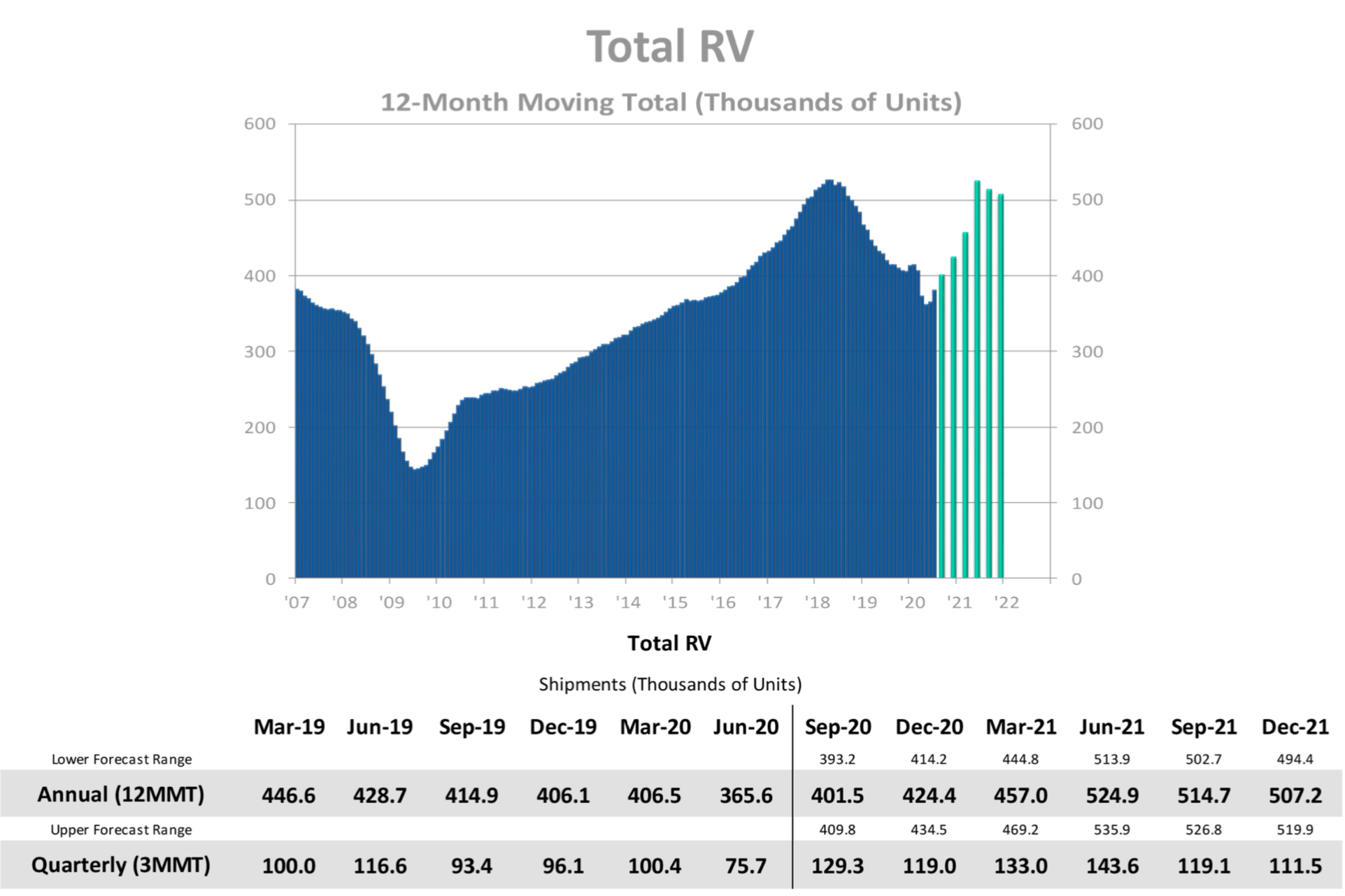

RV shipments are expected to surpass 400,000 wholesale units by the end of 2020 and see continued growth in 2021 to more than 500,000 units, according to the Fall 2020 RV RoadSigns prepared by ITR Economics for the RV Industry Association.

The new projection sees total shipments ranging between 414,200 and 434,500 units with the most likely 2020 year-end total being 424,400 units. That total would represent a 4.5 percent gain over the 406,070 units shipped in 2019, overcoming a nearly two-month RV industry shutdown due to the Covid-19 pandemic. Initial estimates for 2021 have a range of 494,400 to 519,900 units with a most likely outcome of 507,200 units, a 19.5 percent increase over 2020.

The 507,200 units projected for 2021 would represent the best annual total on measurable record for the RV industry, eclipsing the 504,600 units shipped in 2017. The projected 424,400 units in 2020 would be the fourth best annual total on record.

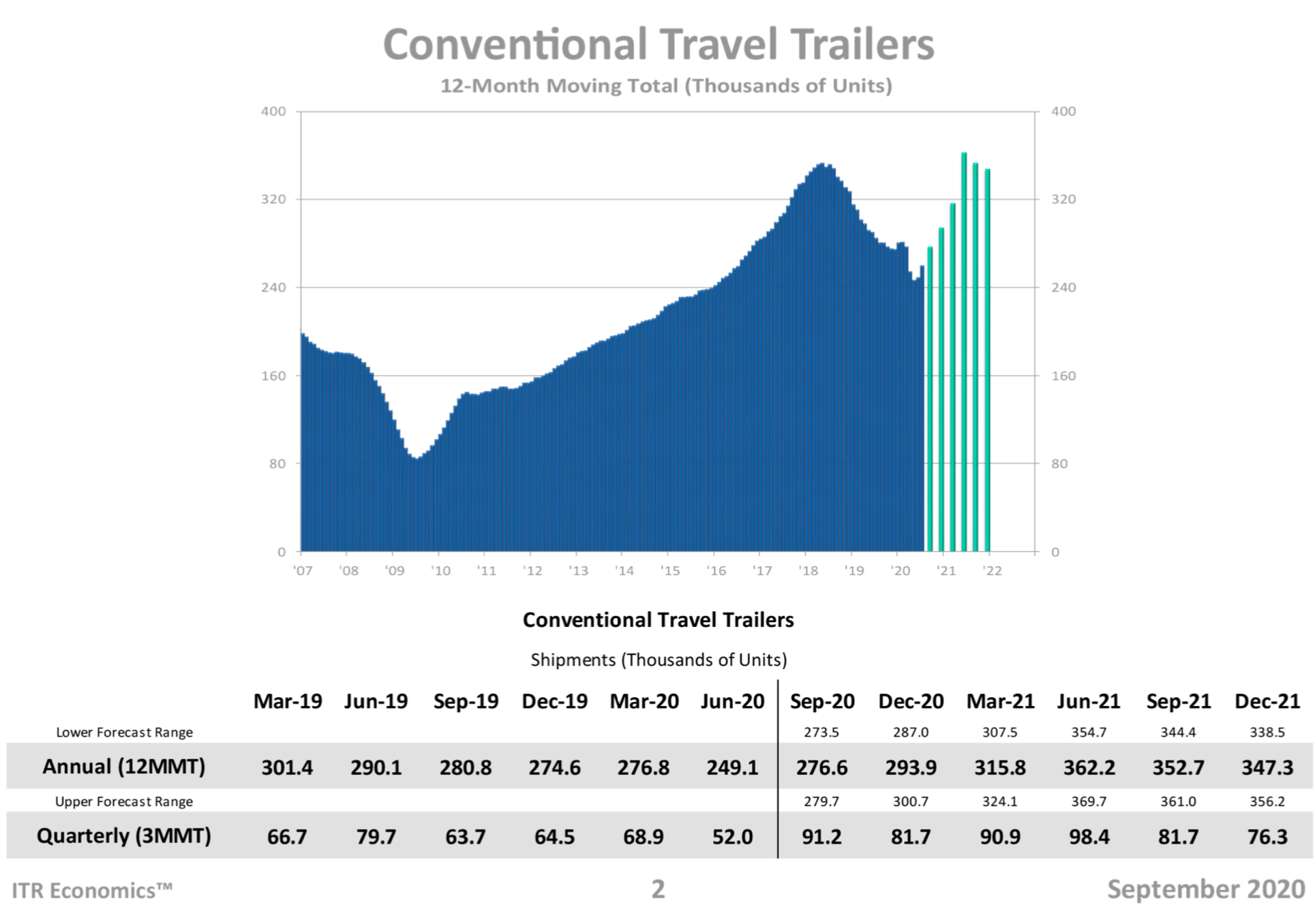

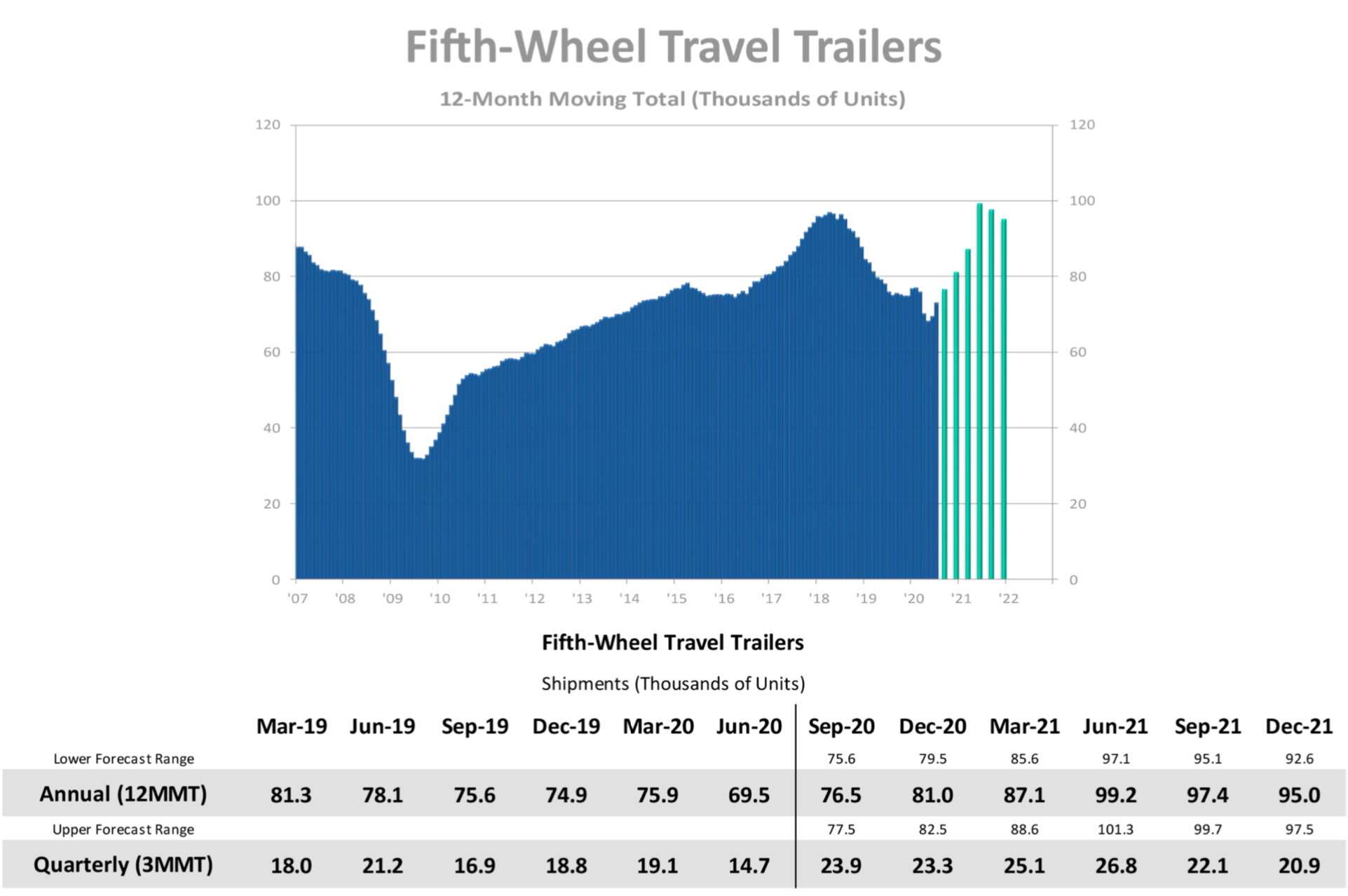

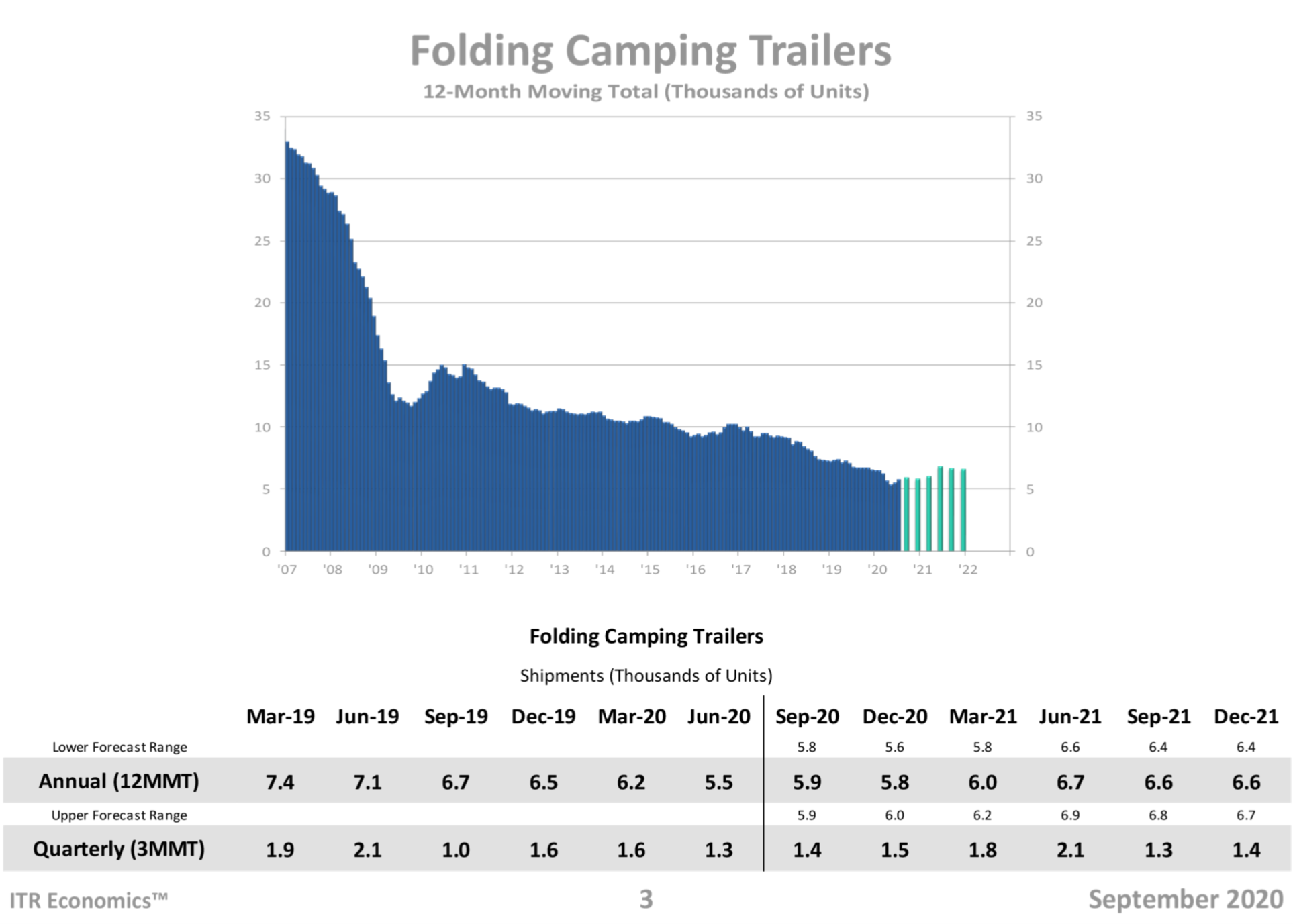

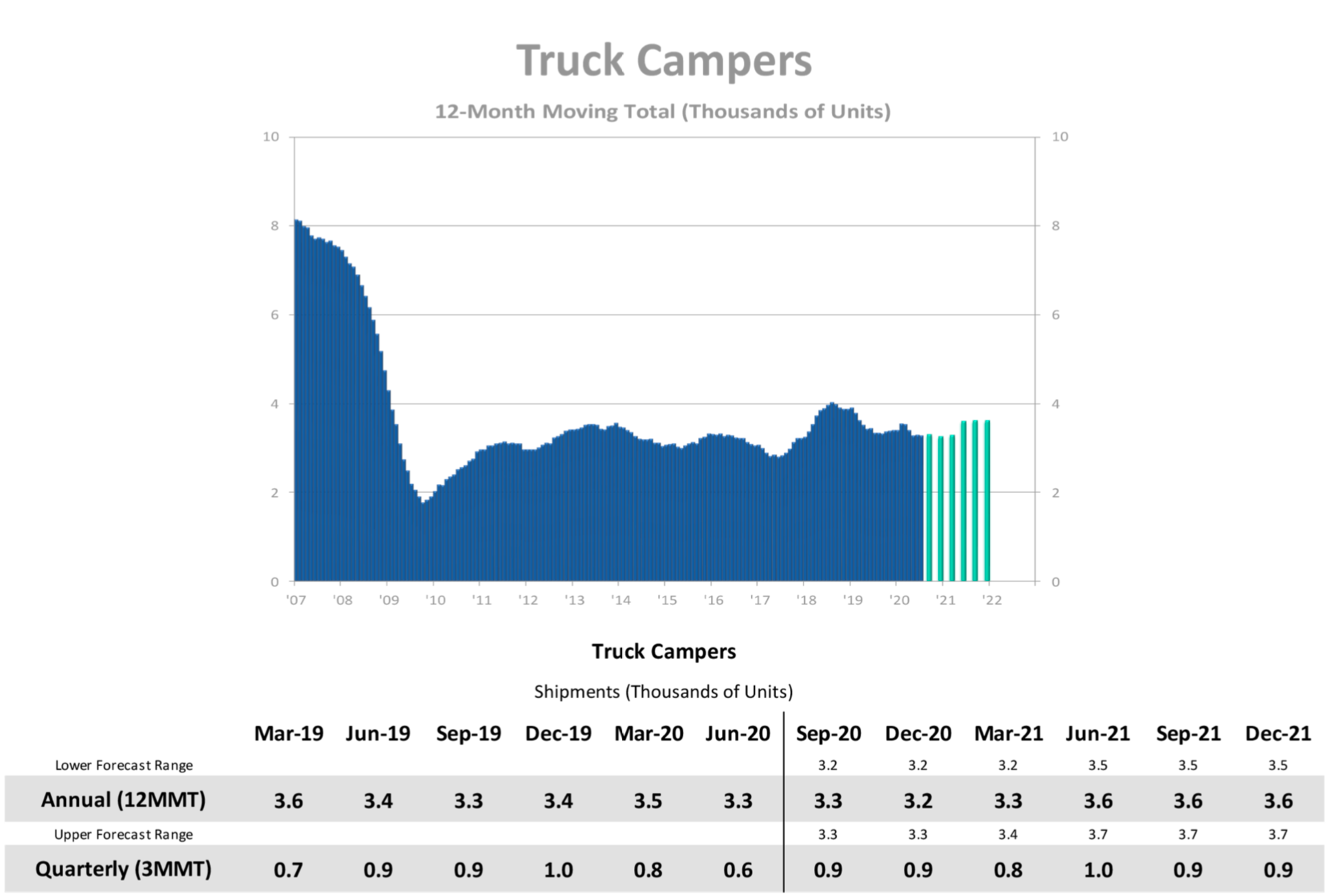

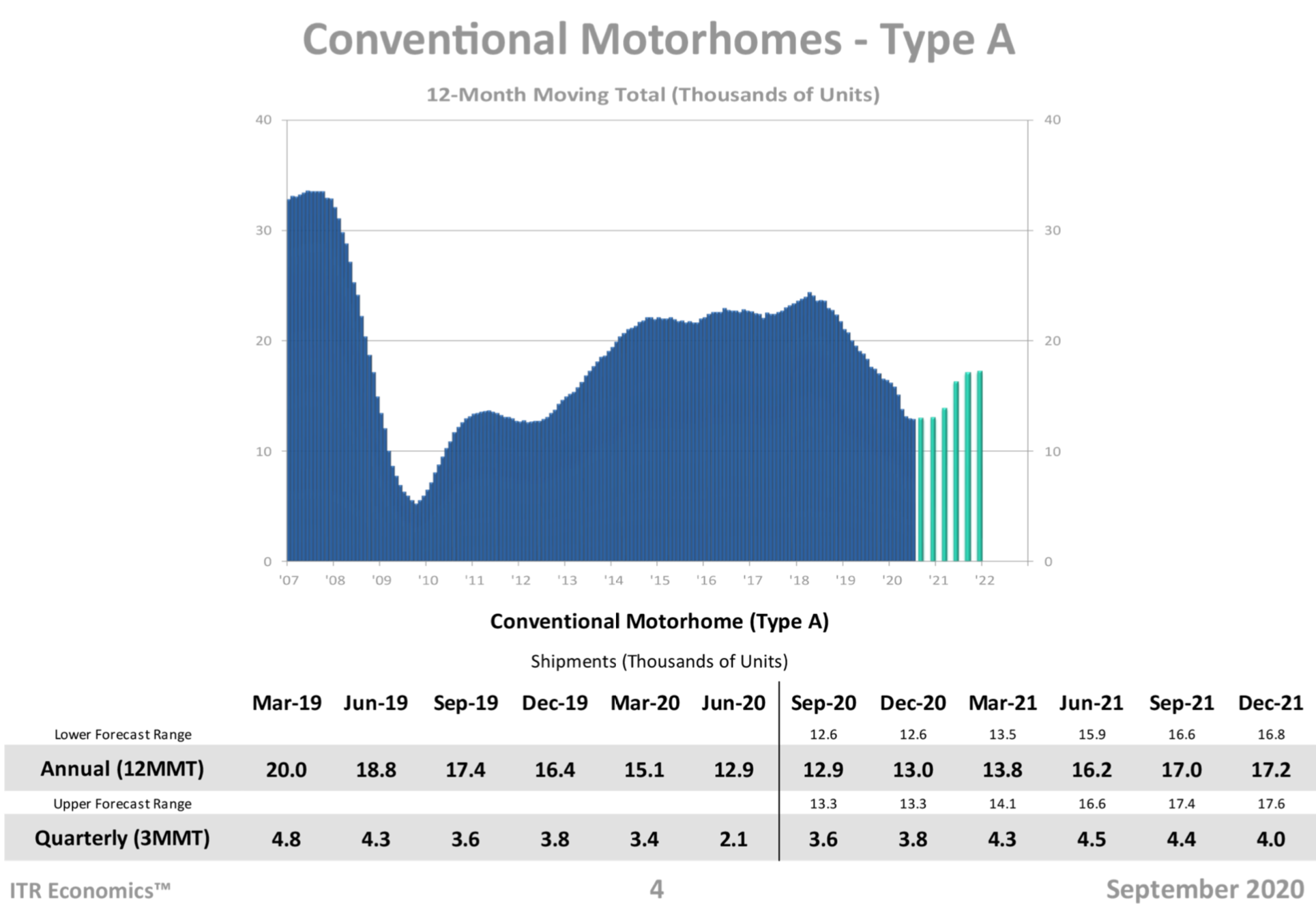

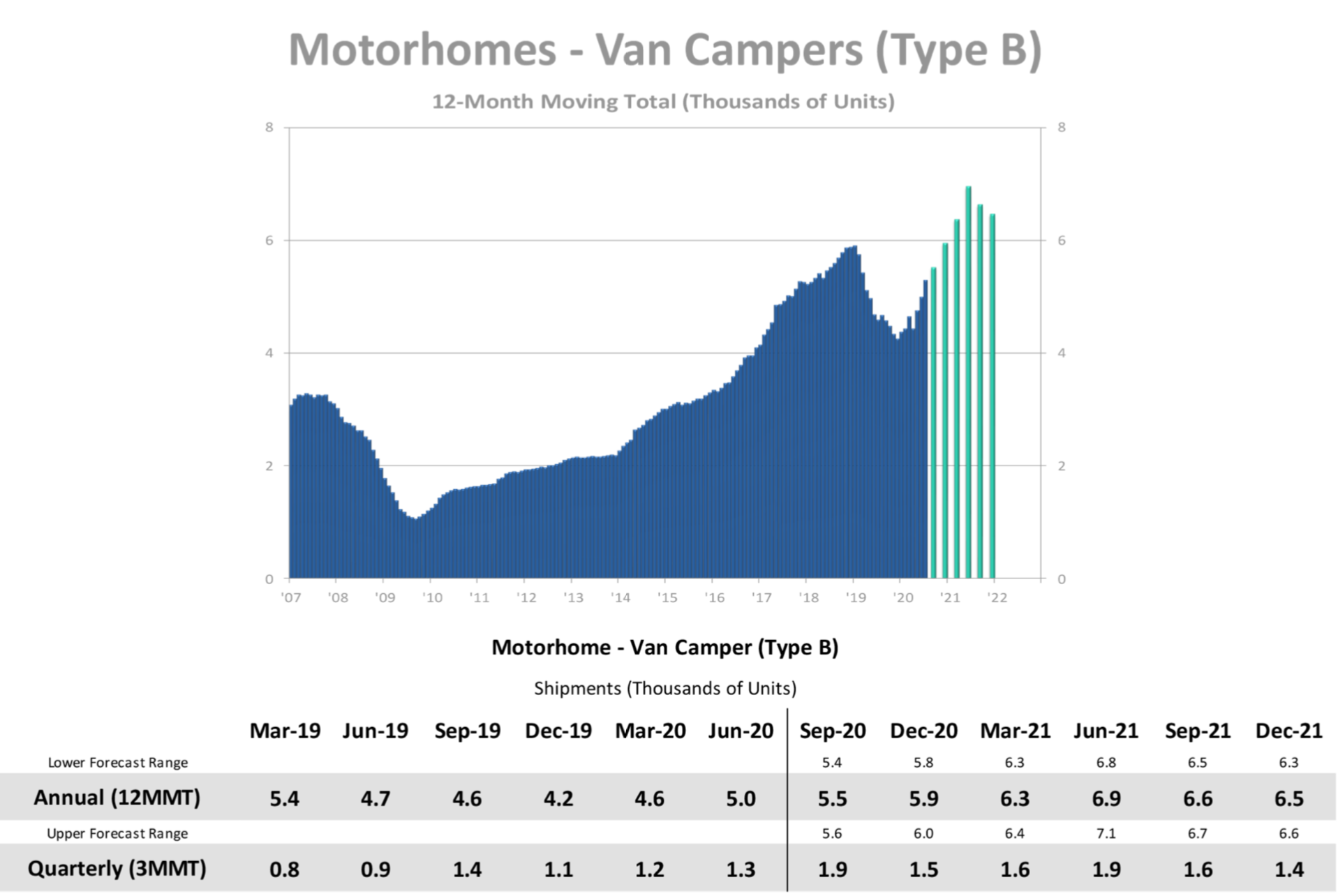

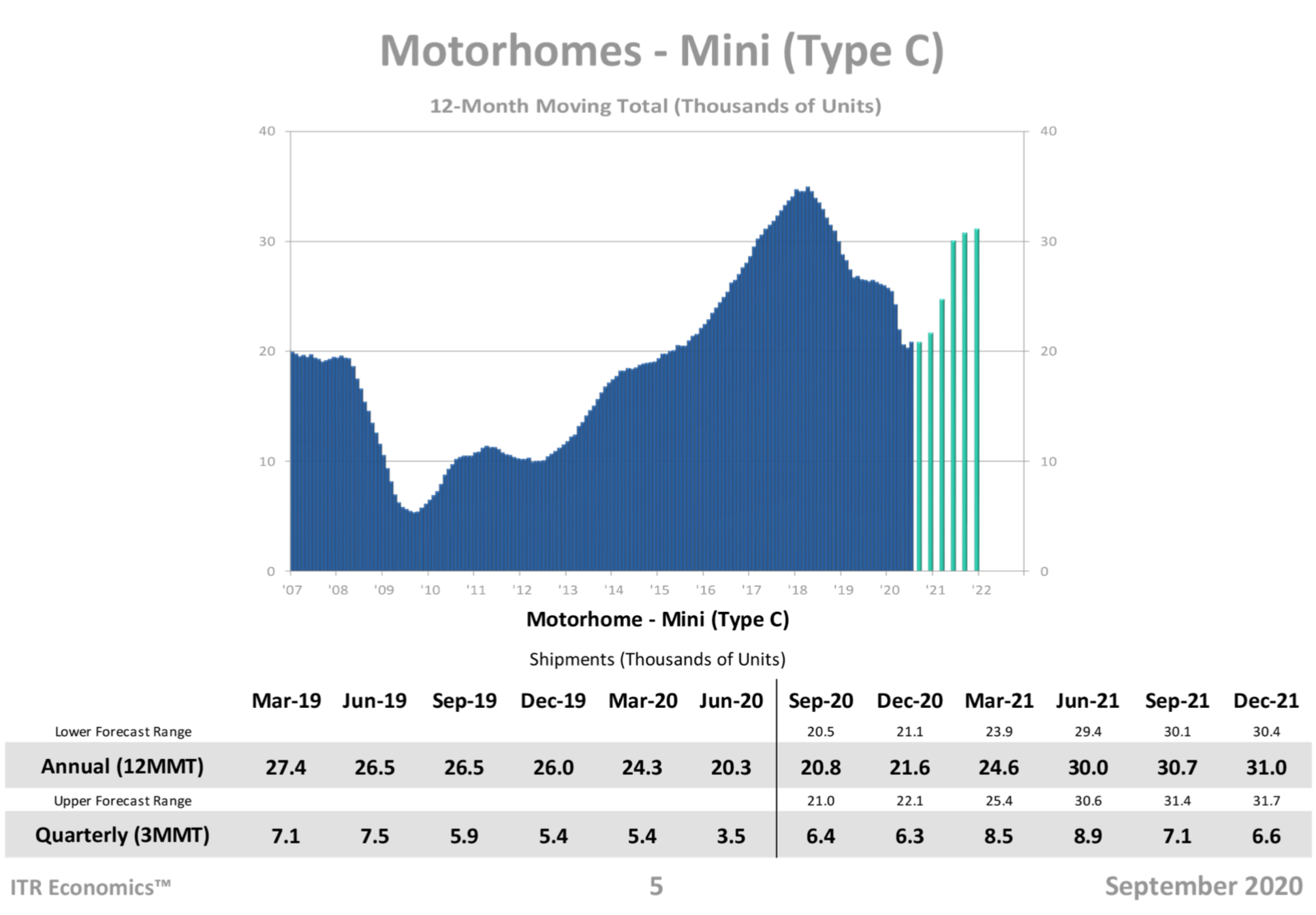

Towable RV shipments are anticipated to reach 383,900 units in 2020 and 452,500 units in 2021. Motorhome shipments projected to finish at 40,500 units in 2020 and 54,700 units in 2021.

“The RV industry has experienced strong consumer growth over the past 10 years, but the recent soar in consumer interest in RVing driven by the COVID-19 pandemic has led to a marked increase in RV shipments to meet the incredibly strong order activity at the retail level,” said RV Industry Association President Craig Kirby. “This new forecast confirms what we have been seeing across the country as people turn to RVs as a way to have the freedom to travel and experience an active outdoor lifestyle while also controlling their environment.”

“RV manufacturers and suppliers have seen historic production numbers this summer as we work to meet the increased demand from customers flocking to the RV lifestyle,” said Kip Ellis, Patrick Industries executive vice president and COO and RV Industry Association Market Information Committee Chairman. “As we continue through the rest of this year and into next year, sustained wholesale RV production will be needed to replenish dealer inventories that are at historically low levels.”

It’s the first-ever RoadSigns prepared by ITR Economics, which the RVIA said is the oldest privately held, continuously operating economic research and consulting firm in the U.S. ITR takes over the report from Dr. Richard Curtin, director of surveys at the University of Michigan, who had been producing it since 1979.

Researchers noted that the industry has reached somewhat of a bottleneck in terms of the supply chain, or the number for 2020 could be even better than they are.

“Like in other recreational industries that have seen sudden Post-COVID-19 surges in consumer demand, supply constraints will likely hinder what could otherwise be an even more robust surge in shipments. OEMs are reporting shortages of parts needed to finalize units, and some are concerned that labor tightness will become an issue given the geographic concentration of the industry’s manufacturing base. We expect supply constraints to gradually ease moving into the first half of next year, but if they are more severe than anticipated, it is likely results will underperform our outlook.”